IRANPOLYMER/BASPAR The plastics industry entered the new decade on an optimistic note. The US-China trade war was pointed towards resolution, concerns over the fallout of Brexit had abated and demand expectations had improved following a lacklustre 2019. Then the coronavirus outbreak changed everything.

The impact on polymer demand has been nuanced. Virus containment measures have seen large portions of economies temporarily shut down. However, some of the slowdown has been offset by frenzied consumer buying of necessities as lockdowns took effect in different regions.

What does it all mean for the plastics industry? Andrew Brown, Senior Analyst, Polymer Demand and Ashish Chitalia, Head of Global Polyolefins at Wood Mackenzie, discuss how a newly-developed coronavirus demand model has highlighted two scenarios: setback and shock.

Supply chain disruptions are at the heart of the challenge

The immediate challenge revolves around supply chain disruptions. Given the global and complex nature of sourcing, many industry participants have had significant challenges accessing and delivering material. Border controls have tightened, leading to lengthy logistics delays.

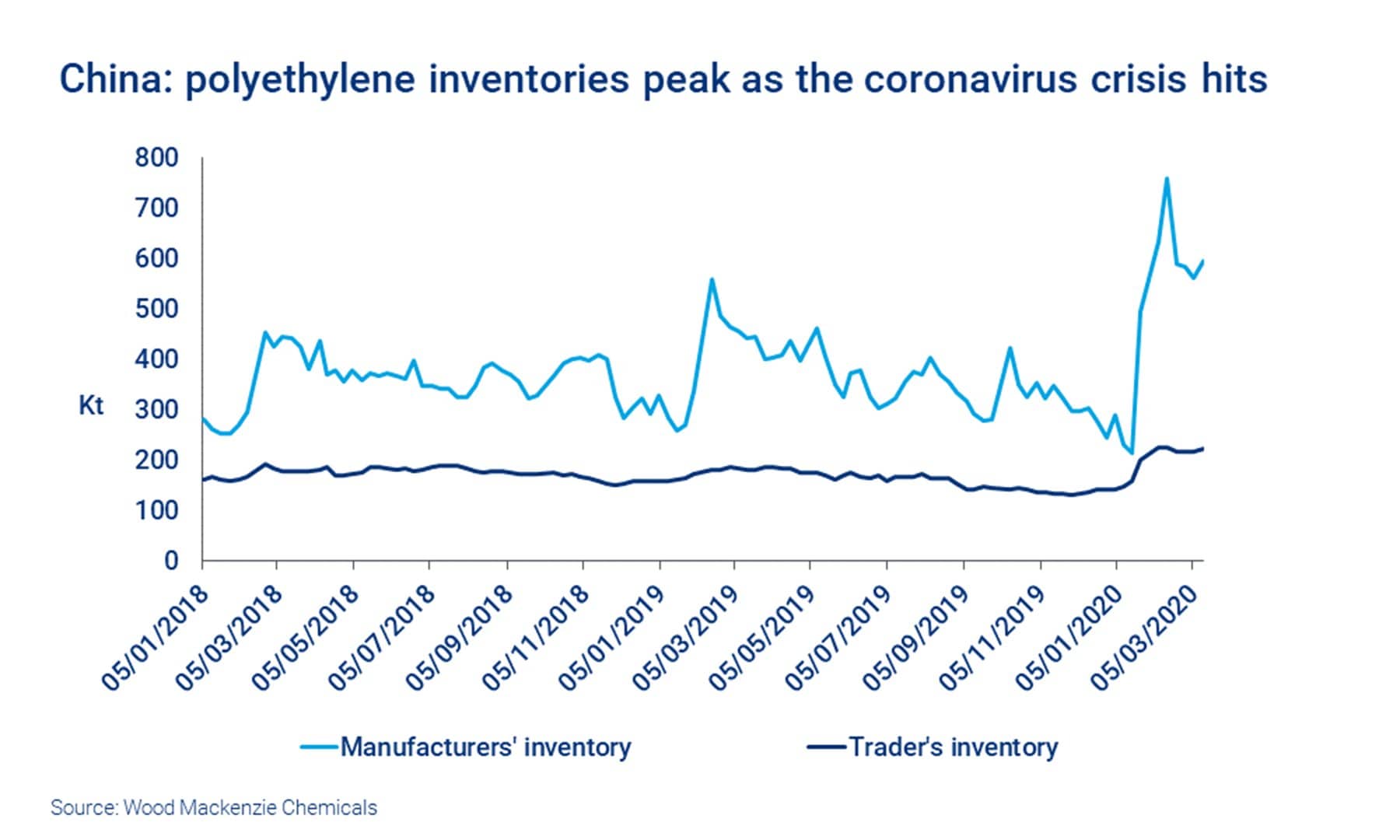

These difficulties have had an immediate impact. As the coronavirus spread in China, we saw a sudden surge in both producer and trader polyethylene inventories.

[EasyDNNGallery|16776|Width|200|Height|200|position||resizecrop|False|lightbox|False|title|False|description|False|redirection|False|LinkText||]

Of course, while China was hit by the effects of coronavirus first the situation quickly escalated on a global basis.

In Europe, many countries are currently facing extraordinary lockdown measures. The US is fighting a similar battle, where converters for medical and other essential goods are bottlenecked by labour shortages in the face of high product demand. India implemented an effective lockdown on 24 March for an initial period of three weeks. As different regions have responded to the virus at different times, supply chains have become increasingly fragile and distressed.

But how will polymer demand be affected?

Two scenarios: setback and shock

Our demand model highlights two scenarios that could unfold for polymers including polyethylene (PE), polypropylene (PP), polystyrene (PS), polyvinylchloride (PVC), nylon (PA6), polyamide (PA66) and polyester (PET Resin).

We looked at the potential impact of these ‘setback’ and ‘shock’ scenarios across the five sectors that drive approximately 80% of demand for these polymers:

- Transportation

- Packaging

- Building and construction

- Electrical/electronic

- Consumer/institutional products.

[EasyDNNGallery|16777|Width|200|Height|200|position||resizecrop|False|lightbox|False|title|False|description|False|redirection|False|LinkText||]

Both scenarios capture the same pandemic response profile (our metric for the level with which populations are constrained by a coronavirus induced lock-down environment) and are reflective of current peak response measures globally.

Under our setback scenario we see significant demand loss in the near term, driven predominantly by the slowdown in transportation as movement is restricted in various regions around the world. Some of the pent-up demand is made up at the end of Q3 as economies return to more normal operation.

Under the shock scenario, more pronounced demand destruction means lost demand is not made up this year.

Transportation takes the hardest hit

In either scenario, polymers with the most exposure to the transportation segments are hit hardest. In China, automotive demand crumbled through the peak lockdown period. So far, the same appears to be holding true for Europe and North America. Of the polymers analysed, polyamides are most exposed, with about half of PA66 demand coming from auto sectors.

But which polymers are exposed to the least amount of risk? And what’s the overall percentage of lost demand in our analysed markets?

source: britishplastics